Tackling rent arrears with digital solutions in Wandsworth

In the bustling world of housing management, rent arrears pose a significant challenge for local councils. The pandemic exacerbated this issue, and the lingering effects of the cost-of-living crisis continue to strain tenants, leaving many struggling to meet their financial obligations. As these arrears accumulate, early intervention to support tenants becomes essential, as it streamlines the engagement, allows services to support the most vulnerable groups, and promotes a reduction in statutory processes.

The Problem

Traditionally, weekly rent accounts in arrears receive reminders only when the first statutory collection letter is dispatched—a full two weeks after the debt has accrued. During this grace period, arrears can grow unchecked, making resolution more challenging for both tenants and the council.

Texting as a Solution

Could text messages provide a faster, more cost-effective follow-up method? As many of us probably already get reminders from energy companies, credit cards or banks the Insight & Analytics Team and Rent Collection Service at Wandsworth Council decided to put this idea to the test.

The goal was simple: nudge tenants as soon as they entered arrears to streamline engagement, support vulnerable tenants and encourage earlier payments, while the debt value was still small and manageable.

The Experiment

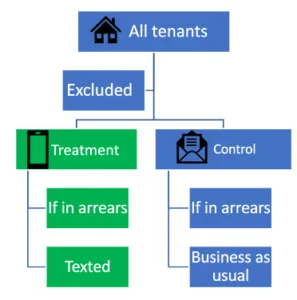

To evaluate the impact of texting, the team conducted a randomised control experiment as it helps isolate the impact of the action (texting) by making control (Business as usual – BAU) and treatment group (texted) similar in terms of their demographics and debt profile to ensure any observed difference are due to the intervention (Figure 1). Please note that those that are monthly payers (Direct Debit/Standing Orders), No mobile number, Non-Residential Accounts were excluded.

Figure 1: Randomised Groups

- Targeted Messaging: Over two 5-week phases, a total of 2,106 text messages were sent using GOV.UK Notify. These messages specifically targeted accounts in initial weeks of arrears or insufficient payments.

- Monday Afternoon: The texts were strategically sent on Monday between 12 and 2pm —a time when tenants are more likely to engage.

- Gov Notify: Gov Notify provides a report of successful and failed to deliver messages. Failed texts impact was excluded from the treatment group analysis.

The Impact

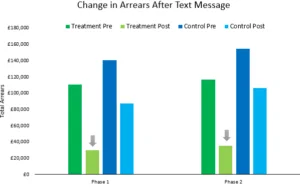

Debt Clearance

Tenants who received reminder texts cleared their debt significantly more often than those who didn’t receive any message. On average, the arrears were lower by £92 and £45 in treatment and control group respectively. Figure 2 shows the change in arrears before (Pre) and after (Post) sending the SMS.

Figure 2: Change in arrears after text message

Early Collection

When the texting strategy is rolled out to business as usual (BAU), it could lead to an estimated £550K-650K of arrears being collected earlier—before the need for a warning letter.

Effective for Smaller Debts

The texts were particularly effective for tenants owing £200 or less. By receiving timely reminders, they regained control of their debt while it was still manageable.

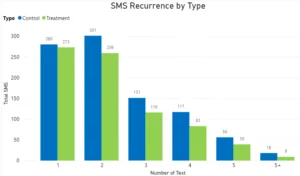

Reduced Recurrence

Interestingly, once someone received a text, they were less likely to fall into arrears again in the following weeks (Figure 3). The same accounts reappeared fewer times during the 10-week trial.

Figure 3: SMS recurrence by type

Reduced Statutory Processes

The need to send a statutory rent collection letter was reduced by 23.5% in the treatment group, saving staff time. Moreover, the average number of calls to the Rent Collection Service dropped by 22%, further freeing up officers’ time. These savings allowed officers to focus on offering targeted support to the most vulnerable groups.

Conclusion

In summary, text messages proved to be an effective tool for the rental collection service in helping manage debt. By intervening early and providing gentle nudges through a digital solution, councils can improve rent collection efficiency, empower tenants, and prevent arrears from becoming an unmanageable debt which creates a risk to tenancy sustainment.

This blog was written by Radhika Karwa (Lead Data Scientist), Lisa Poole (Head of Parking Compliance and Rent Collection) from Richmond and Wandsworth Councils.

Lisa Poole

Radhika Karwa